Where did your Building sum insured come from?

It’s impossible to escape the impact of inflation rates in the UK. The effect is harsh and wide-reaching, and insurance is no exception. Increased cost of claim settlements and their subsequent effects on premiums are the most visible impact but, unfortunately, not the most dangerous.

Underinsurance, of buildings in particular, has been a long-standing and severe issue in insurance. Whilst the majority of home insurance policies are now written on a ‘blanket’ cover basis, with a limit of £500,000 – £1,000,000 generally being adequate for the average property, any policy for which a sum insured is specified is at risk of underinsurance, whether it is for a consumer or commercial client. This includes bespoke home insurance, property owners and all commercial insurance risks.

The Royal Institute of Chartered Surveyors (RICS) accredited surveyors, RebuildCostASSESSMENT.com undertake an annual analysis of their data; in 2022 this was from 27,000 properties surveyed over a 12-month period:

- In 2021 80% of properties were underinsured

- By 2022, this had increased to 83% due to inflation

- The average level of underinsurance in 2021 was 66%

- By 2022, this had increased to 68%, again due to inflation

- The worst group of properties is those up to £500,000 in value, which are on average only covered for 51% of their rebuild cost

This situation will only worsen in the current economic climate.

Evidently, underinsurance was a major issue prior to inflation, however with RICS recommending that sums insured currently need to be increased at renewal by 13% for Commercial and 16% for Residential properties, this is only likely to worsen unless close attention is paid to your sums insured.

So our question to you is this – Do you know where your building sum insured came from?

If you’re unsure, it’s likely to be inaccurate. It is important to also note that this bears no correlation to the retail value of a property.

We work with new and existing clients to review their sums insured and arrange RICS desktop surveys from as little as £105.00 plus VAT.

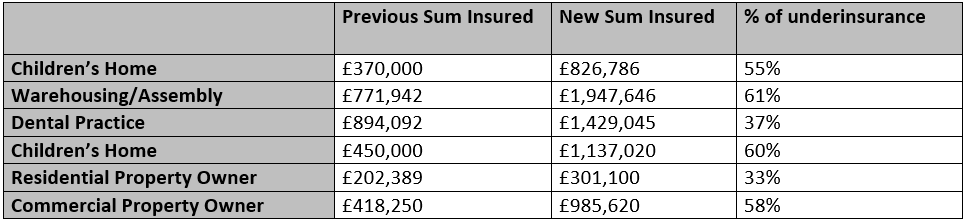

Some examples of underinsurance from 2022 new clients include:

Had any of these properties suffered a loss, average would apply and the claim would be proportionately reduced. For example, a £100,000 claim with 60% underinsurance would only receive payment of £40,000.

Buildings are often your most valuable asset, therefore it is critical to ensure that they are insured correctly and for the right sums to avoid catastrophic losses in the event of a claim.

If you wish to discuss this further, please do not hesitate to get in touch with us.